Bitcoin halving, one of the major events in early 2024 for cryptocurrencies, went off without a hitch. A month later, its first consequences are felt on the famous currency and market.

A month ago, on the night of April 20, the 840,000th block of the Bitcoin blockchain was mined and the fourth halving took place. This halving of mining profits, which the entire cryptocurrency sector had been expecting for four years, was surrounded by a special aura: the predictions were very different from those made in previous dates.

May 21, 2024, a month later, what’s going on? While it is generally accepted that a period of one month is not enough time to really see the impact of a cryptocurrency halving, this year is exceptional. Indeed, based on certain factors, experts have predicted for the first time that this event does not necessarily cause a sharp increase in prices. Is one of the three scenarios analyzed by Numerama playing out?

A month later, where is the price of bitcoin?

The halving is a remarkable event that gets people talking every time, and for good reason: by halving the rewards given to miners on the Bitcoin blockchain, the halving artificially creates scarcity. Its very nature compels speculation – and each time, during previous iterations, the halving has been followed by an impressive surge in cryptocurrency prices.

But the predictions for the 2024 division were different. Industry experts hypothesized three likely scenarios.

- Bitcoin rises: like the previous edition, Bitcoin is boosted by the halving and its price explodes.

- Bitcoin stagnates: some experts have pointed out that at the beginning of 2024, more than a month before the halving, Bitcoin has already reached a new record price. After this initial momentum, which was largely driven by the arrival of Bitcoin ETFs, observers feared that the market would run out of steam and that further growth would therefore be difficult to imagine.

- Bitcoin is going down: JPMorgan Bank predicted a fall of Bitcoin to $40,000, like what happened to Bitcoin Cash, a derivative of the classic Bitcoin, after its own reduction in early April.

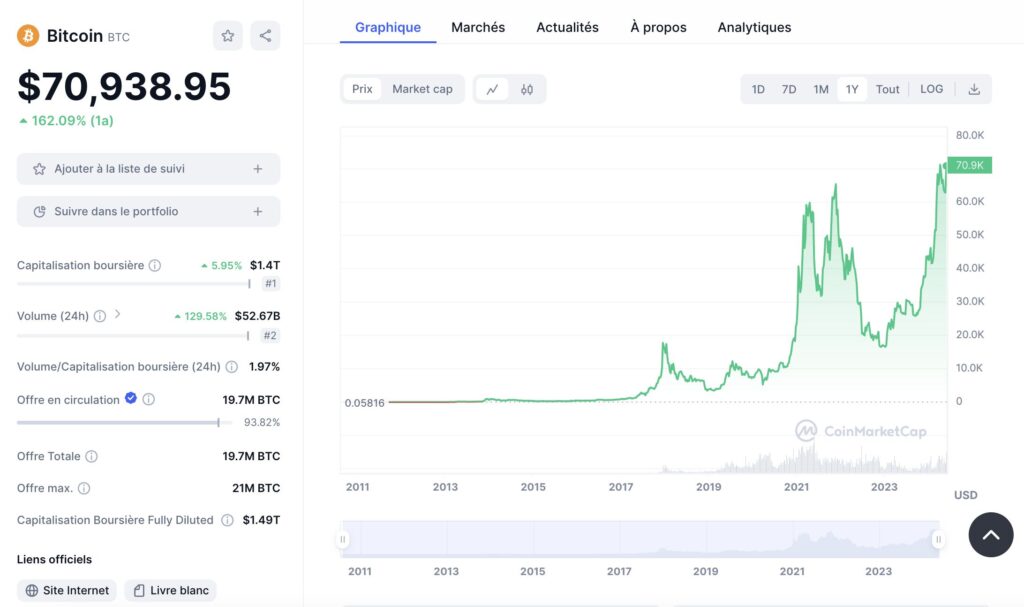

What is the situation today? Bitcoin, which hovered around $60,000 just after the halving, is now around $70,000. While these early numbers are good, they are not the significant increase that some were expecting. It can be noted that Bitcoin oscillates between a growth and stagnation scenario.

Does that mean it’s necessarily permanent?

That being said, it’s important to note that it’s too early to tell the long-term effect of this split. In November 2012, when the first halving took place, the first effects were observed only a few months later: the first peak at $140 occurred in April 2013, almost 5 months later, and the first explosion of its price occurred in November 2013, i.e. a year later.

Ditto for the second one, which occurred in July 2016, but whose effects were actually felt a year later, in June 2017; as for the third one, which took place in May 2020 and whose increase did not follow until January 2021. To have a definitive confirmation of its effect on Bitcoin, we still have to be patient.

However, we can note that the consequences of the halving seem to be felt earlier and earlier. Moreover, the very specific profile of this 4th bisection could lead to special consequences, different from those we know for others.

Subscribe to Numerama in Google News so you don’t miss anything!