Far from the euphoric times of 2021, today the queen of cryptocurrencies faces a wall that prevents her from climbing to greater heights. Worse, its price seems to be dropping. Where does the problem with Bitcoin and other cryptocurrencies really come from?

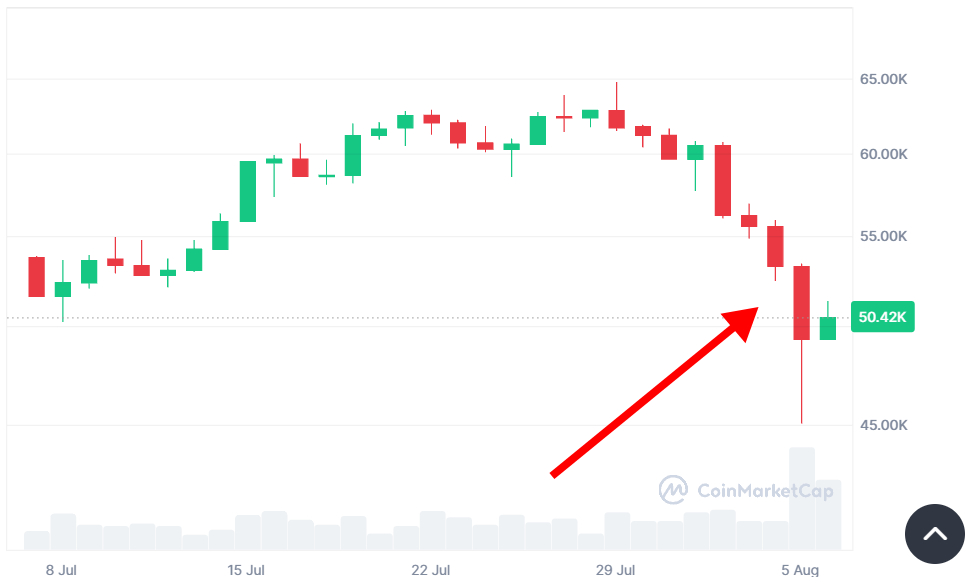

The lack of clear direction in recent months has left the cryptocurrency community in limbo. And for good reason, Bitcoin is systematically setting the course for other cryptocurrencies. If the first virtual currency goes up, the rest of the market follows, it’s that simple. Today, however, Bitcoin does not seem determined to return to new highs. According to our colleagues from Cryptoast, it even lost 17% of its value in a few hours on the night of Sunday August 4th to Monday August 5th, 2024.

A promising start to the year for Bitcoin

However, at the beginning of the year, everything seemed to be fine. In 2024, the value of Bitcoin was heading upwards, after a down year marked by major events for the crypto ecosystem, such as the collapse of the crypto platform FTX. In March, the cryptocurrency even reached EUR 64,000 and set a new price record, narrowly surpassing the old ATH (all time high : the highest price the cryptocurrency has ever reached) exceeded €56,000 in November 2021. This increase was mainly triggered by the arrival of Bitcoin ETFs, a financial instrument that allows exposure to Bitcoin without owning any. In short, a kind of introduction of Bitcoin into traditional finance.

But the move up was mainly motivated by the halving, a process written into Bitcoin’s code that cuts the cryptocurrency’s miner rewards by two.

While this type of event has historically given rise to a bull run – a long period of overall growth in the cryptocurrency market – it is still nothing like that today.

Bitcoin even has a downtrend, with sharp moves like this Monday, August 5, when it fell below €50,000.

Bitcoin Crash: What Happened This Monday August 5th?

During the night of this Sunday, August 4, to Monday, August 5, 2024, the hopes of crypto investors took another blow. In fact, Bitcoin went from €54,000 to around €45,000 before stabilizing around €50,000 on August 6. Volatility in this market is part of the game, but since this 17% drop in a couple of hours, a lot of people are talking about a Bitcoin crash. But what exactly is it?

Although there is never a 100% proven reason to explain such a financial movement, certain causes nevertheless make it possible to establish a more or less accurate diagnosis of the Bitcoin situation.

Several experts seem to agree that one of the reasons for this year’s fall will be the global financial context. Since the beginning of the week, global stock markets in Europe and on Wall Street have been in the red. But it was the Asian market that opened first as the Tokyo stock market fell. This would explain the timing of the bitcoin crash that happened in the middle of the night with a time difference. This is a tightening of Japan’s monetary policy with a 0.25% increase in key rates by the central bank.

These measures have been stepped up around the world since the end of the covid crisis to curb inflation. But all this is obviously not conducive to growth, because the central bank is feverishly lending money.

How can Bitcoin bounce back?

In all of this, Bitcoin is still subject to the influence of the macroeconomic context, which rather causes a reluctance to invest one’s money in the financial markets. Savings are essential and cryptocurrencies still remain extremely correlated with traditional stocks. Simply put, the more scarce liquidity becomes, the less inclined bitcoin and other virtual assets will rise.

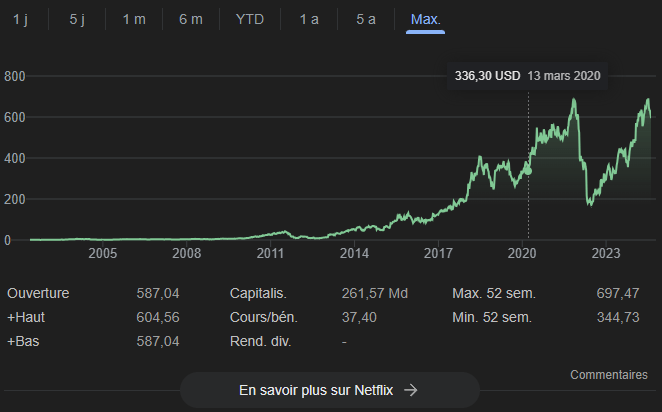

Above all, this point seems to determine the value of Bitcoin and even other assets. For example, the last surge in cryptocurrency in 2020, after the covid-related crash, was initiated by historic money printing. Several technology-related stocks benefited greatly from this favorable financial context, such as Netflix and Tesla – before collapsing like Bitcoin in November 2021.

Bitcoin’s fundamental problem

Although this context plays a significant role against Bitcoin, it is not the only one that prevents its value from growing. In recent years, the crypto ecosystem has been marked by heavy events such as the bankruptcy of the crypto platform FTX or the collapse of the crypto Terra Luna.

All this will inevitably affect the confidence of investors who have seen their money gobbled up by high-profile fiascos. And the disabled are not just individuals. The dominance of certain entities in the market does not help: the shares of the pie seem to be distributed within a small privileged group that plays with the reputation of the supposedly decentralized cryptocurrency. This is the case with the platforms or exchanges that are today the first proxy holders of cryptocurrencies. It only takes one of them to hit a snag and crash the market. This is nothing new, the MtGox platform already showed the shortcomings of this system before the fall of FTX.

In addition to this centralization, there is also the issue of availability. Today, the so-called virtual currency is still not very viable for everyday use, despite the simplification of the interface and payment processes, for example through the Bitcoin Lightning Network. In El Salvador, Bitcoin was introduced as legal tender, but only 12% of Salvadorans were reported to be using Bitcoin in 2023, reflecting this lack of intuitiveness.