Monday, June 3, 2024 ▪

5

min reading ▪ acc

Between groundbreaking announcements, technological developments, and regulatory turbulence, the crypto ecosystem continues to prove itself to be a land of limitless innovation and a field of regulatory and economic battlegrounds. Here’s a roundup of the most notable news from the past week on Bitcoin, Ethereum, Binance and Solana, etc.

Bitcoin’s hashrate reaches an all-time high

Bitcoin’s hashrate has reached an all-time high, proving the resilience of miners and confidence in the crypto despite post-halving fears. The total computing power deployed has surpassed its previous records, supported by technological advances and the recent increase in the price of BTC. These factors helped to offset the reduction in block rewards, thereby strengthening the mining ecosystem. This performance underscores bitcoin’s robustness and reassures investors of its long-term fundamentals.

BlackRock invests $10 million in Ethereum for its new ETF

Asset management giant BlackRock is preparing to launch an Ethereum ETF following the success of its Bitcoin ETF. The company invested $10 million to purchase Ether to create a fund with an initial net asset value of $10 million. The ETF, which will trade under the ticker ETHA, will have the Bank of New York Mellon as custodian and Coinbase as the holder of the underlying ether. The launch of the ETF is expected as early as the end of June, according to Bloomberg analyst Eric Balchunas.

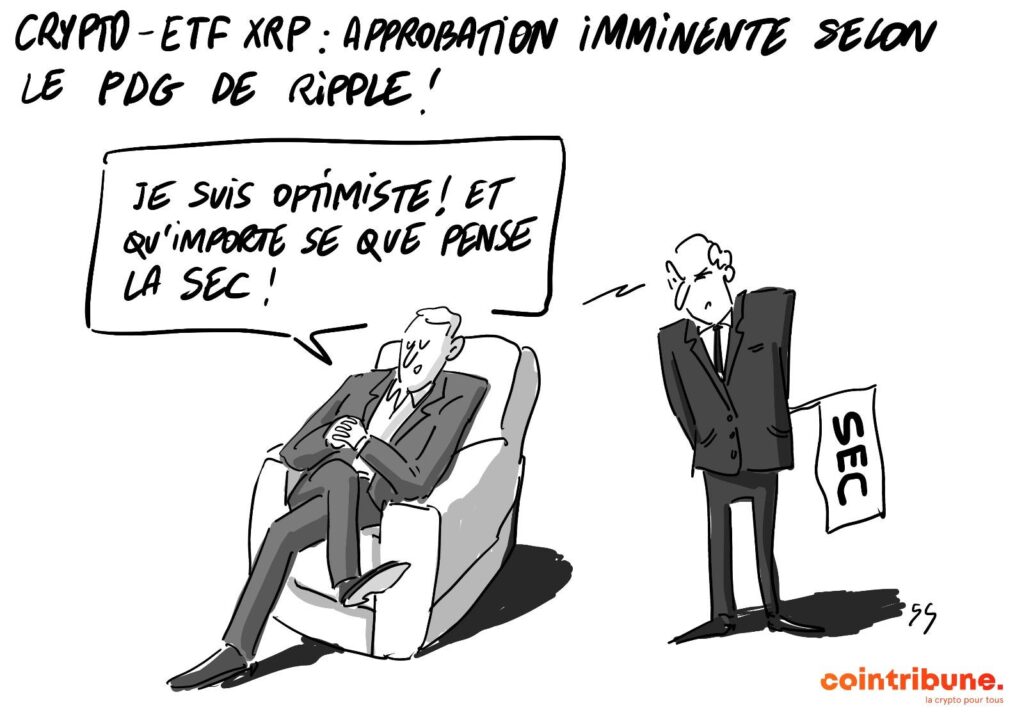

XRP ETF: Approval is coming, according to Ripple

Ripple CEO Brad Garlinghouse announced at the Consensus 2024 conference that the approval of the XRP ETF is inevitable, despite the current regulatory issues. This prediction follows Standard Chartered’s prediction that the XRP ETF will launch by 2025. While the cryptocurrency is currently down and trading below $0.549, the optimism around the ETF could be a game changer. Legal clarity remains key, and a favorable ruling for Ripple in its legal battle against the SEC could accelerate institutional adoption of XRP.

Binance’s Changpeng Zhao was jailed for 4 months

The founder of crypto exchange Binance, Changpeng Zhao, has been jailed for four months at a low-security federal prison in Lompoc, California, after pleading guilty to money laundering operations through his platform. The sentence, shorter than the three years sought by prosecutors, marks a turning point for the crypto sector. Zhao expressed regret and acknowledged the importance of compliance. The future of Binance under new leadership is full of uncertainty.

Bitcoin: Institutional investors’ frenzied hoarding resumes

Large institutional investors are repeating their Bitcoin accumulation strategy reminiscent of the period before the bull rally of 2020. Ki Young Ju, CEO of CryptoQuant, reported strong activity similar to that seen before the price surge in late 2020, with daily transactions exceeding a billion dollars . Although volatility is moderate, this accumulation could herald a new bull cycle. Analysts differ on the immediate implications, but many predict that Bitcoin could break the $69,000 resistance and set the stage for new highs.

That’s the main thing to remember this week. But if you want a more detailed recap and in-depth analysis delivered straight to your inbox, be sure to subscribe to our weekly newsletter.

Maximize your Cointribune experience with our “Read and Earn” program! Earn points for every article you read and get access to exclusive rewards. Register now and start reaping the benefits.

Click here to join “Read and Earn” and turn your cryptocurrency passion into rewards!

A graduate of Sciences Po Toulouse and holder of the blockchain consultant certification issued by Alyra, I joined the Cointribune adventure in 2019. Convinced of the potential of blockchain to transform many sectors of the economy, I made a commitment to raise awareness and inform the general public about this ever-evolving ecosystem. My goal is to enable everyone to better understand blockchain and take advantage of the opportunities it offers. I strive every day to provide an objective analysis of current events, decipher market trends, convey the latest technological innovations, and put into perspective the economic and social issues of this ongoing revolution.

DISCLAIMER OF LIABILITY

The comments and opinions expressed in this article are solely those of the author and should not be considered investment advice. Before making any investment decision, do your own research.