With a halving, miners get half as many bitcoins. Every four years, their remuneration is automatically reduced, challenging the viability of their economic model. How are miners managing to be profitable despite this drop in revenue?

Mining refers to the process of verifying transactions made on the Bitcoin blockchain. This system guarantees the security of the network, thanks to the computing power of the computers used. With the halving, Satoshi Nakamoto wanted to give Bitcoin the same properties as gold, which becomes increasingly difficult to mine over time. However, this mechanism also poses an existential question for minors.

For this fourth halving, the rewards earned for mining a block immediately increased from 6.25 to 3.125 BTC. However, to be profitable, a miner must be able to sell their bitcoins for more than what they spent on electricity.

Bitcoin price growth: the holy grail for miners

So, in order to remain profitable, miners must bet on the price of Bitcoin multiplied by two. But this ideal scenario is unlikely to come true, even though a $100,000 Bitcoin is increasingly being considered. In the absence of guarantees, miners must build solid cash flow, which tends to centralize the industry around big players, such as in Texas.

Fortunately for them, the price of Bitcoin exploded upwards shortly before the halving. This situation is unprecedented, as previous halvings always resulted in increases a posteriorinever before. Therefore, the early rise in the price of Bitcoin is a boon for miners who have made significant profits to go through this ordeal more calmly. Even miners whose economic model is no longer viable could survive if given time to adjust. This is the big difference between this halving and the previous ones.

Race for the cheapest electricity

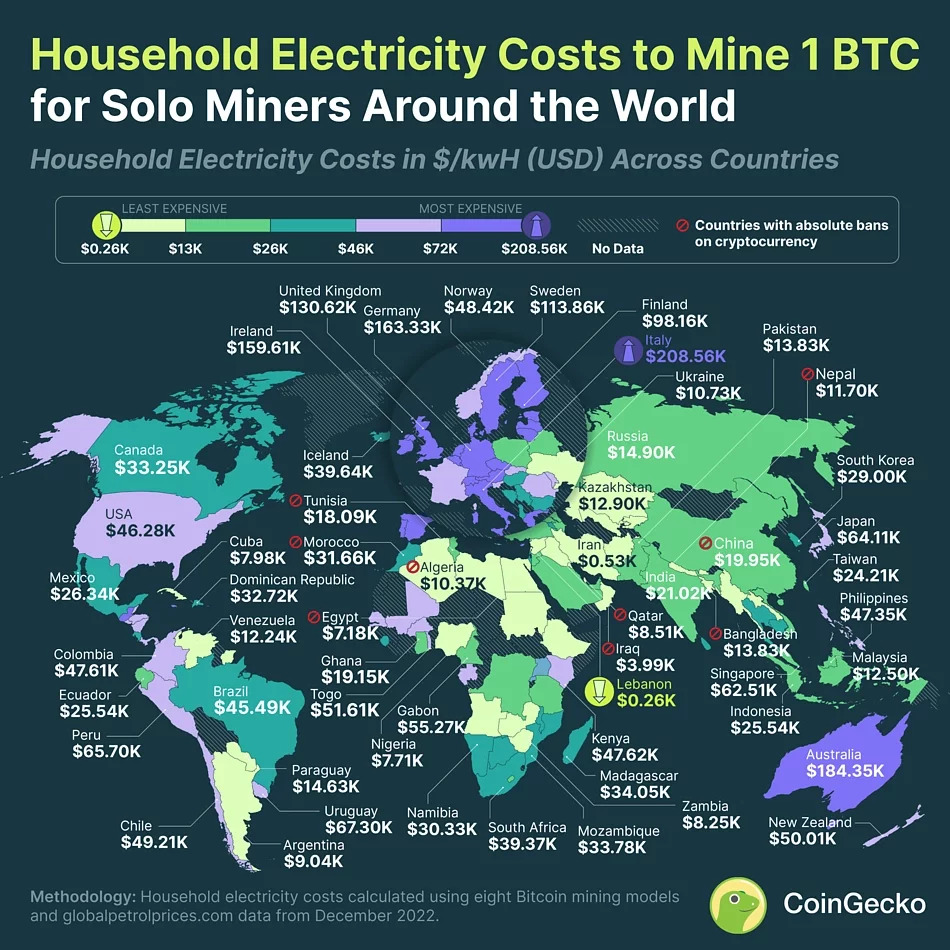

If the price of Bitcoin is very volatile, there is a lever that miners can act on: the price of electricity. Highly variable depending on the region of the world, the price of a watt is at the center of this industrial struggle.

Countries such as Kazakhstan or Ethiopia are well known in the industry for their attractive prices and friendly policies towards mining. To reduce costs, some miners specialize in renewable energy bitcoin production, focusing on geothermal or hydropower. In the Democratic Republic of Congo, Virunga National Park sells surplus electricity from its hydraulic dam to mining companies. This type of configuration has a two-fold advantage: electricity costs are affordable and fixed.

The CoinGecko study gives an idea of the cost of producing Bitcoin depending on the regions of the world. The prize for the most profitable country thus goes to Lebanon, with the theoretical cost of producing one bitcoin only 260 dollars. While Italy ranks last in the class with an average price of $208,000. However, apart from these huge differences, other parameters like security and taxation are also part of the equation.

Crush the competition

In order to always be profitable, miners can also modulate the operation of their Asics machines, devices specially developed for this use. With experience, they learn to anticipate lean periods and join when the network sees more activity, which is synonymous with higher profitability. This explains why the overall strength of the Bitcoin network experiences strong fluctuations with each halving.

The best Asics can be purchased for over $10,000. We also see their prices spike as each halving approaches. In fact, miners renew their fleet in advance to have the best consumption/performance ratio when the time comes. And with the inevitable disappearance of certain miners during the halving, these producers are reclaiming their competitors’ market shares in the process.

Bank for network charges

To survive the halving, miners can count on one last resource: transaction fees on the Bitcoin network. This fixed amount ensures a stable and regular income. So users pay between 1 and 2 euros for a bitcoin transfer. Cumulatively, an average of $7 million a day comes into the miners’ pockets.

But there is instability for this fourth half wish severely overloaded the network, leading to exorbitant costs. Transaction fees quickly rose to $127, according to data from BitInfoCharts. A record that far surpasses the $60 seen in 2021. This turbulence was already seen in Bitcoin Cash, a cryptocurrency derived from BTC, which was halved two weeks earlier. A return to normal is expected in the coming weeks.

In the future, these network fees, which can be likened to tips, will be essential. They will become a real financial incentive for the mining industry as block rewards for miners decrease.